My Role

Lead Product Designer

Strategy · UX · Workflow Design · Cross-Org Alignment

Over a year-long engagement on the Tacoma platform, I partnered closely with Product,

Engineering,

and Tax Operations to redesign how tax rules move from creation to production at scale.

I joined during the final pre-launch phase, where core functionality was largely in place, and

focused on strengthening the tax rule authoring and deployment experience. I identified critical

workflow gaps that posed adoption and usability risks, and worked with cross-functional partners

to resolve them ahead of launch.

I led a 4-month end-to-end redesign of the deployment workflow, spanning:

- User research and walkthroughs

- Workflow modeling and validation

- Design delivery and launch adoption

Post-launch, I continued working directly with users to understand how teams were transitioning

from Excel-based authoring to ETCOM. I synthesized insights across teams, surfaced mental-model

mismatches, and translated findings into a prioritized improvement backlog presented to

leadership,

ensuring the platform evolved with real operational needs.

Case Study — Deep Dive

The Problem: A Fragile Legacy System

Amazon’s legacy Rule Management System, built in 2012, had evolved into a high-risk operational

bottleneck that managed 800,000+ tax rules across 19 services and processing nearly 13 trillion

calculations every month.

Rule Authoring

(Excel-based)

Manual edits

No dependencies

→

Coordination

(Email / Slack)

Ownership unclear

Version conflicts

→

Validation

(Late-stage)

Errors discovered

too late

→

Production

(High Blast Radius)

One mistake affects

millions of users

Despite this scale, tax rules were still:

- Authored and edited manually in Excel

- Coordinated through emails and Slack threads

- Deployed via fragmented, opaque workflows

At this volume, small mistakes had massive consequences.

In one instance, a single rule issue halted Prime Now orders across four EU markets for several

hours. The system was reliable only as long as nothing went wrong, but this was no longer

acceptable.

Key Users

Key Users & Accountability

Tax Rule Author

Business User

Primary responsibility

Create and maintain tax rules that directly impact production calculations.

Core pain

Manual, error-prone authoring with limited visibility into dependencies and

downstream impact.

Risk they carry

A single mistake can cause incorrect tax calculations or customer-facing outages.

What success looks like

Confidently author rules with clear validation, visibility, and safe deployment.

Tax Rule Deployment Owner

Operations

Primary responsibility

Validate, approve, and deploy tax rules across regions and services.

Core pain

Fragmented workflows, manual coordination, and poor visibility into deployment

readiness.

Risk they carry

Failed or partial deployments that disrupt production and trigger compliance

incidents.

What success looks like

Predictable, auditable releases with real-time status and safe rollback options.

Solution: What is ETCOM?

ETCOM modernizes how Amazon’s tax teams create and manage tax rules. Previously, tax

analysts

had to download Excel files, make changes offline, and re-upload them often juggling Slack

threads to coordinate who was editing what. It was slow, error-prone, and mentally

exhausting.

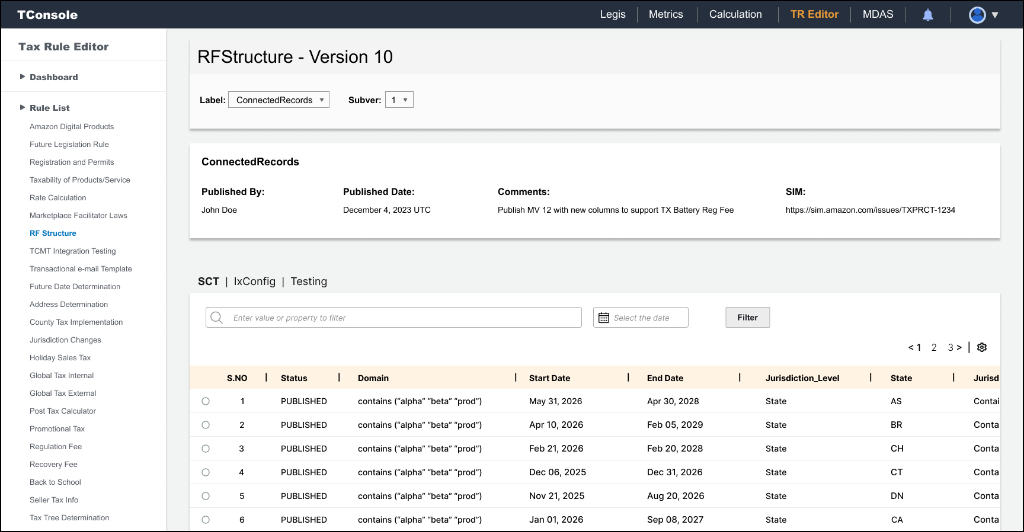

With ETCOM rule authoring happens directly on the platform, where updates are instantly

visible

to everyone.

Each change is tracked, clearly showing who made what edits, which has greatly improved

transparency and collaboration. Testing and deployment are now streamlined, saving hundreds

of

manual hours. The next phase,launching this December introduces AI-generated rule authoring

from

legislation, further accelerating accuracy and efficiency.

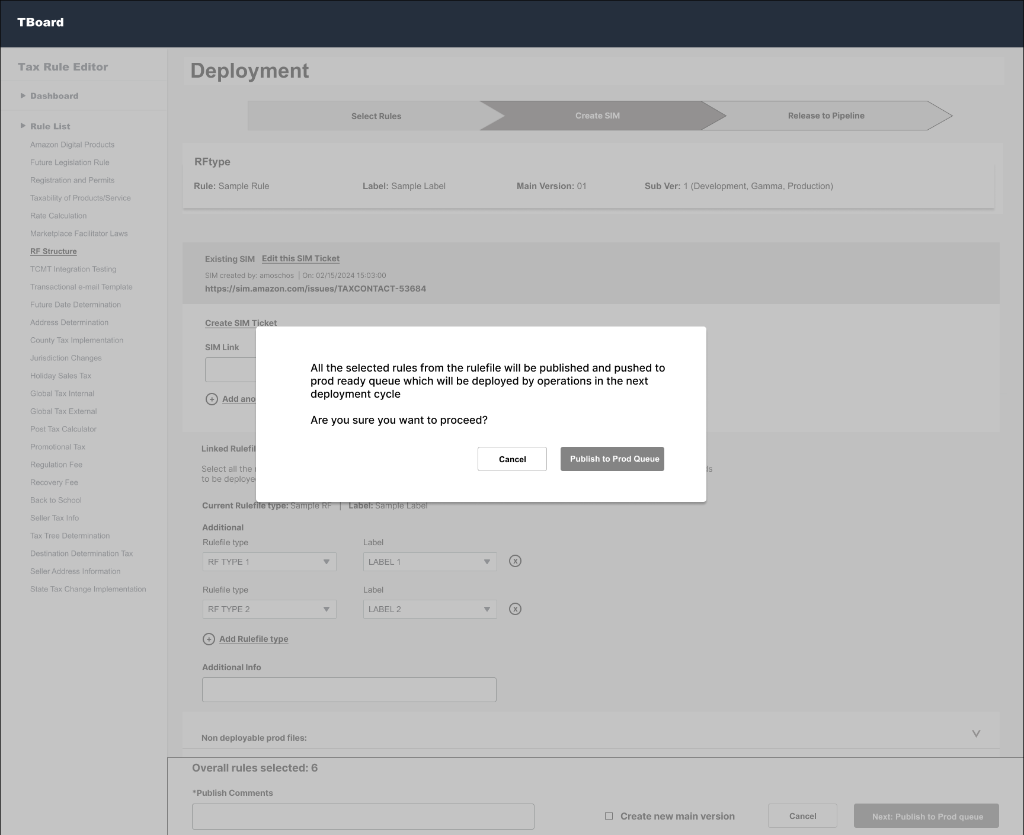

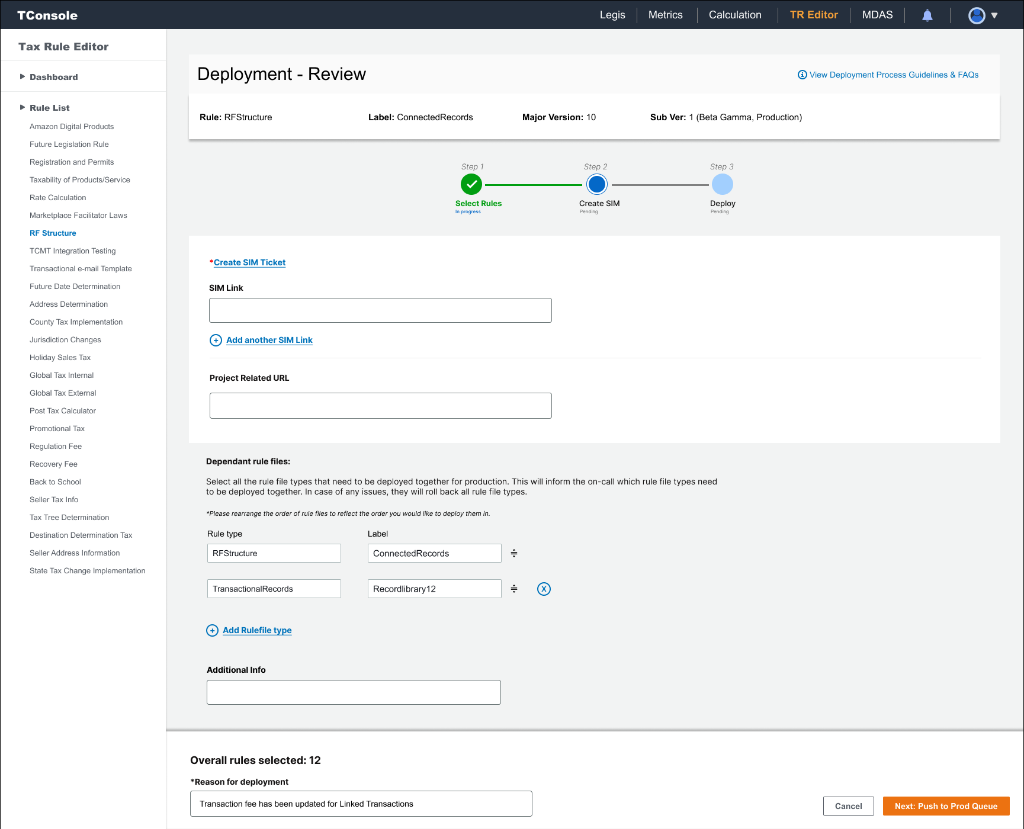

Key Design Decisions

Decision

Deploy rules as explicit snapshots instead of individual rule

releases.

Why

Prevent partial or inconsistent production states.

Outcome

Predictable releases, safer rollbacks, and fewer production

incidents.

Decision

Designed a step-based deployment experience instead of exposing

raw engineering pipelines.

Why

Business users lacked visibility and confidence in

developer-centric tools.

Outcome

Faster adoption and reduced dependency on engineering support.

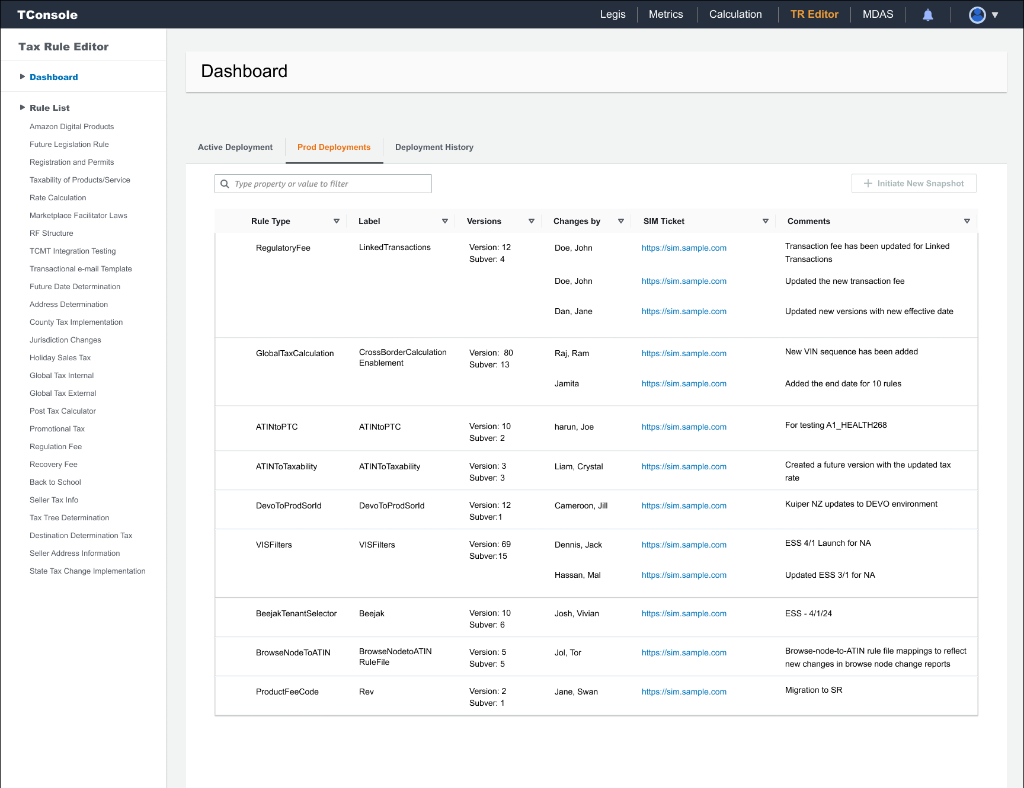

Decision

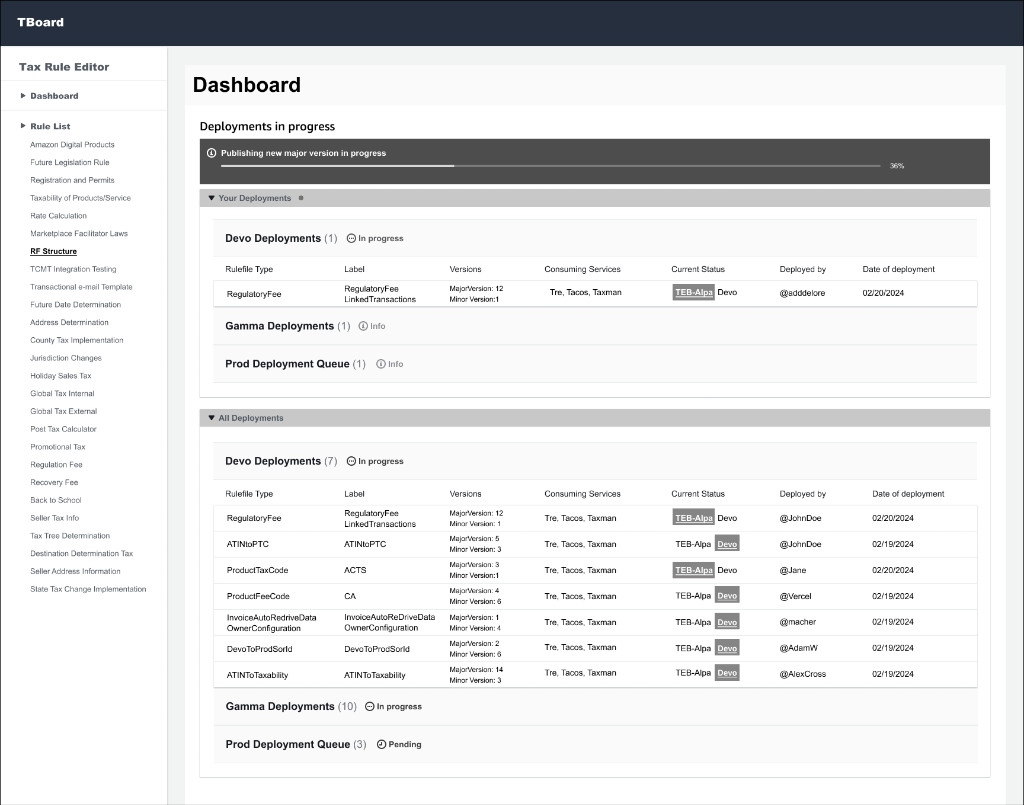

Centralized deployment status, ownership, and audit history in

one place.

Why

Fragmented ownership increased risk and slowed incident

response.

Outcome

Clear accountability, faster issue resolution, and compliance

confidence.

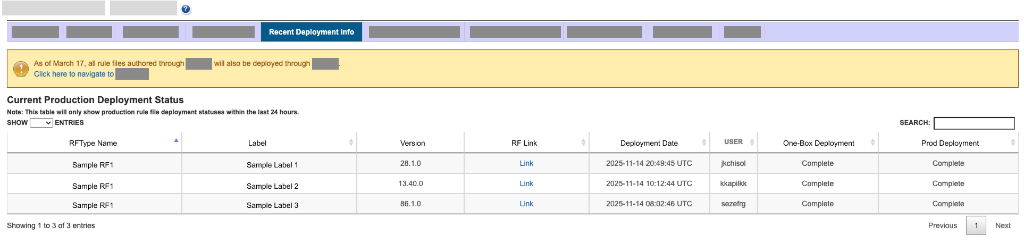

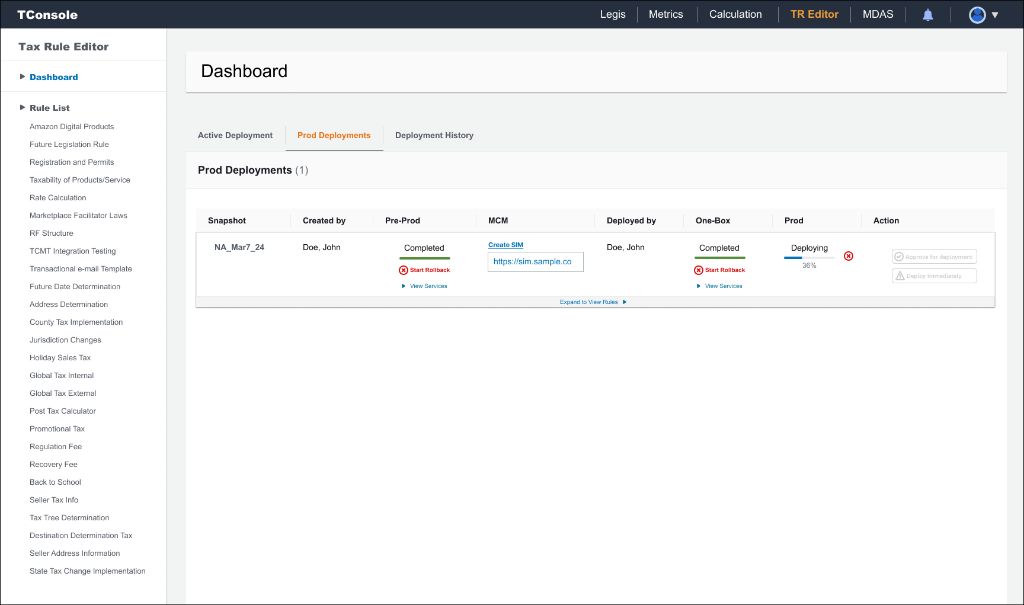

Rulefile Deployment

Reimagining the Workflow

Before: Manual & Fragmented

Rule changes lived across spreadsheets and services.

Teams coordinated changes through email and Slack.

Validation happened late, often after bundling.

Deployments were slow and unpredictable.

After: Unified & Automated

Rules authored and managed in one platform.

Ownership, status, and readiness visible in real time.

Validation and testing embedded in the workflow.

Releases were predictable, auditable, and safer.

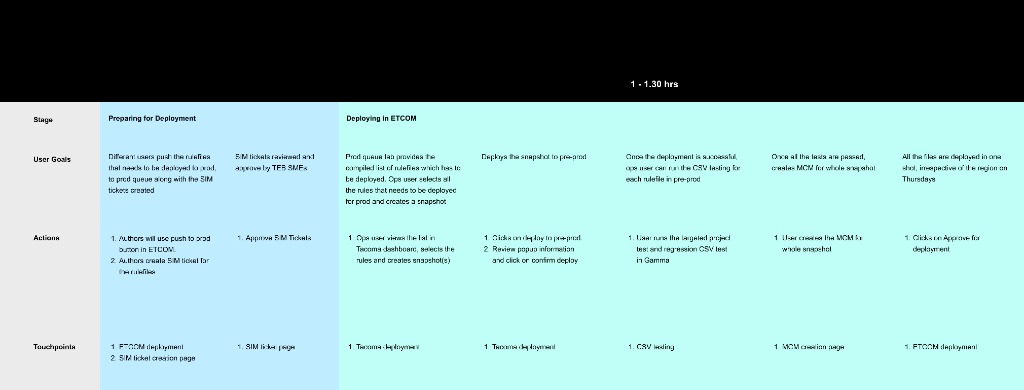

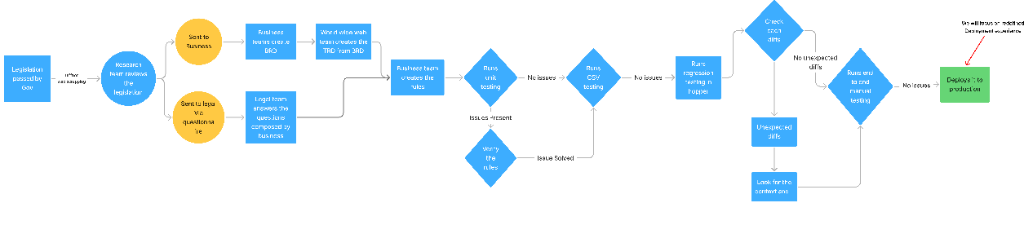

User Journey

Etcom User Journey

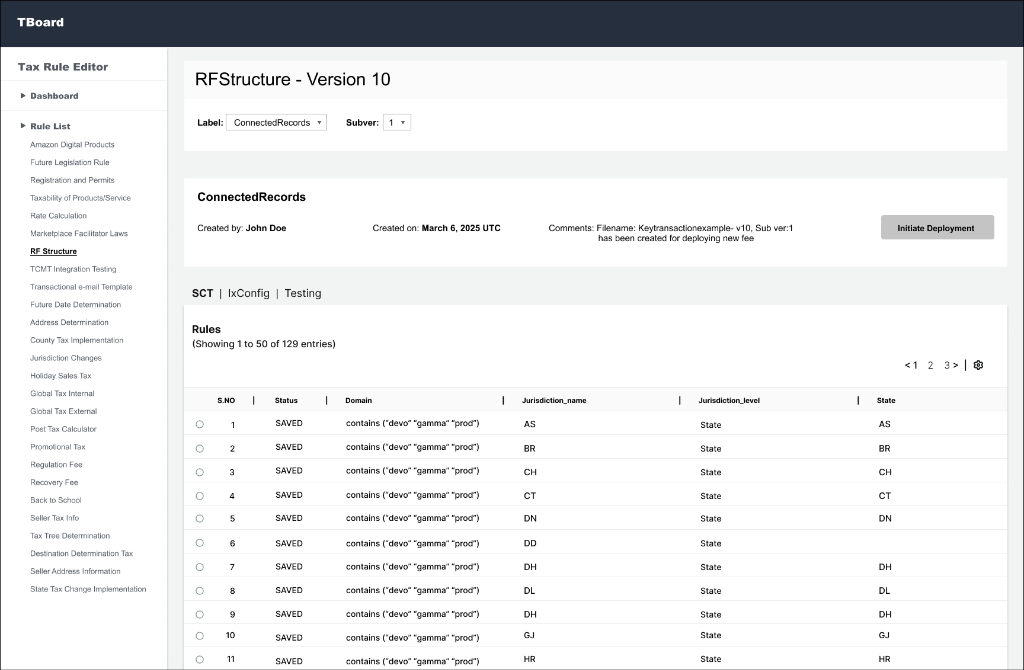

Wireframes

Design Evolution

High-fidelity wireframes visualizing the new consolidated workflows.

Before & After

Legacy vs ETCOM

Legacy System

The legacy system does not have step by step guidance or tracking mechanism to help users

update on the progress.

ETCOM

ETCOM provides easy rule(s) selection mechanism.

Overcoming Hurdles

Implementation Challenges

Constraint

Engineering preference for reusing the existing code deployment

pipeline UI

Risk

Non-technical users lacked visibility and deployment confidence

Approach

Live walkthroughs paired with quantified usability and error risk

analysis

Outcome

Alignment on a simplified, guided deployment experience

Validation

Customer Walkthrough Sessions

To validate adoption and de-risk rollout, we conducted structured

walkthroughs with end users before and after launch.

👥

3 focus groups · 37 participants across Content

Authors and Tax Engine Operations, with Approvers and Service Owners included for

cross-functional visibility.

🖥️

Hands-on walkthroughs of the redesigned deployment flow

✨

Feedback directly shaped final interaction patterns, validation

steps, and tracking

Feedback

What People Are Saying

“ETCOM turned my ‘Thursday-palooza’ into a ‘One-Hit

Wonder.’ Now it’s just one validation, one click, one success email—and I get an

hour of my day back. That’s not just time saved, that’s freedom.”

Tim Robbins

Tax Engine Manager (Operations)

“Publishing Gamma rules is now straightforward. ETCOM

automatically deploys the right file version, removing extra manual steps.”

Macy Johnson

Sr. Product Manager

“This new testing strategy builds real

resilience—preventing errors before release and strengthening customer trust.”

John Mason

Director of Product Management

“Deployments run smoothly. I’d love to see consuming host

visibility added back, but the new workflow already improves accuracy and

confidence.”

Tom Chang

Software Dev Engineer II

Outcome

A Reliable Foundation for Scale

ETCOM transformed tax rule deployment from a fragile, manual process into a reliable,

governed platform operating at global scale.

Beyond efficiency gains, the work reshaped how teams reason about readiness, ownership, and

the balance between speed and compliance.

Most importantly, ETCOM established a foundation where automation could be trusted because

governance was built into the system, enabling the next phase of AI-assisted rule creation,

explored as a separate case study.